Looking Back at Lakeland Real Estate Market 2017

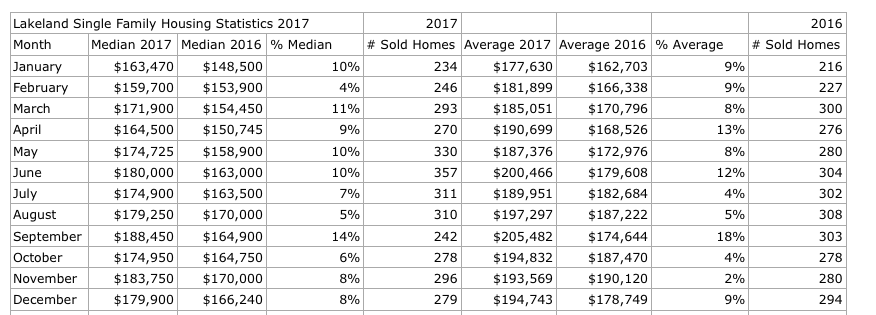

So how did we finish 2017? The Lakeland real estate market has been characterized by a relentless listing shortage and increased housing prices. Sales of new homes sales as well as existing homes has been the highest in decades. As you can see from the chart below of existing home sales, the median sales price and average sales price increased every month from the year prior. The number of sales have remained the same or dipped from 2016. But the sales have also increased concomitantly, despite the rise in price. Part of the reason for this happens to be new ways of marketing and improved sale tactics. For example, there is this new real estate drone tech, Let’s Fly Wisely, that enables you to see every nook and corner of a real estate property. This tech is relatively new but has proven to be quite successful. You can read my Lakeland Real Estate Market Report for December by clicking: Lakeland FL Real Estate Market – December 2017

What contributed in increased housing prices?

Supply and Demand – When supply is high, demand is low, the prices of homes are decreasing; conversely, when supply is low and demand is high, the prices for homes are increasing. The Lakeland Real Estate Market continued to experience a housing shortage throughout last year. If we take a look at available months housing inventory, six month should be a normal market. [clickToTweet tweet=”2017 Lakeland FL Real Estate Market! For the last three years, we haven’t seen a six month inventory. #lkld #realestate ” quote=”For the last three years, we haven’t seen a six month inventory.”] According to Lakeland Association of Realtors, the supply hovered around 2.5 month since May 2017. This is one of the reason why existing single family home prices have increased.

Another critical driver of supply constrain is that existing homeowners are compelled not to list their homes of fear that they are not finding a suitable home to purchase. In addition, according to National Association of Realtors, homeowners elect stay longer in their homes at a median tenure of 10 years.

Mortgage Interest Rates – Mortgage interest reached the lowest point at 3.78% in September 2017 according to FHA . While mortgage interest rates have been historically low for number of years, it is also an indication that more buyers and move up sellers took advantage of low interest rates.

Unemployment Rate – Polk County unemployment rate was at 4.3% in November 2017. The healthy labor market and higher wage gains along with low interest rates gave buyers confidence to look into purchasing a home.

Thoughts on the Lakeland real estate market trend for 2018

When it comes to purchasing homes, Lakeland is still affordable compared to Tampa where median sales price are at $240,000 and Orlando’s median sales price is at $250,000.

Mortgage Rate are projected to rise up to an average of 4.13% in the 1st Quarter, 4.28% in the 2nd Quarter, 4.38% in the 3rd Quarter and 4.53% in the 4th Quarter. So by the end of the end of the year, the average is over 4 1/2%. We are sitting just about 4% now.

Will the new tax bill influence the housing market? While the tax bill may have some impact in the mid-upper range luxury home, I believe it will have little or no impact for the majority of sellers and buyers here in Lakeland.

The most thorough analysis of how tax reform will affect the housing market has come from Capital Economics. Here are some highlights:

- The tax bill could raise the net costs of buying. But, given most households will see an overall tax cut, and potential buyers are likely to put that saving towards their home, we doubt it will have a significant detrimental impact on the housing market.

- Most households stretch themselves when buying a home, and to the extent that the new code will cut taxes for most households, the overall change could be positive for the housing market.

- The impact on expensive homes could be more detrimental, with a limit on the mortgage interest deduction raising taxes for that itemize.

People don’t buy homes because of tax breaks. It is still the American dream to own a home. According to NeighborWorks America’s who did a survey, how important a part of the American dream is owning a home? 71% think it’s the most important or very important. 22% think it’s somewhat important.

It looks like that more and more construction being added to the Lakeland housing market. Villages at BridgeWater, Hampton Hills, Donovan Trace, TerraLargo, Highlands Creek II, Highlands Grace, Towne Park Estates II, Acres of Lake Gibson, Creeks Crossing, Hallam Preserve, Enclave at Harden, and Grasslands.

The builders have to realize not only to cater to the luxury market. There are a lot of buyers in the lower and mid-range market unable to find homes in the lower to mid-range market.

Final Thought

I believe that buyer demand remains strong and the reason sales have not skyrocketed is because of the low inventory. I believe the Lakeland FL 2018 Real Estate market can be great if our inventory reaches a balanced market.

________________________________________________________________________

About the author: The above real estate article “Lakeland Real Estate Market 2017 “ was written by Petra Norris of Lakeland Real Estate Group, Inc. With over 20 years of combined experience of selling or buying, we would love to share our knowledge and expertise. Petra can be reached via email at petra@petranorris.com or by phone at 863-712-4207

We service the following Central Florida areas: Lakeland, Auburndale, Mulberry, Winter Haven, Bartow, Plant City, Seffner, Valrico, Polk City, Lake Alfred, Lake Wales, Haines City, and Davenport FL.