Deciding whether to buy a home this year or wait is a tough decision, because you never know what the future holds. However, if you think about it, how many times have you listened to “experts” who make a prediction about the housing market and it never comes to pass?

Probably more often than not…right?

Here’s an example, if you researched this same question at the end of last year, all the experts said the Fed was going to continue to raise the interest rates in 2019—they haven’t! Additionally, they aren’t giving any indication that they will do so any time soon. It’s almost June—halfway through the year—and they haven’t yet.

On that same note, if you were asking yourself this same question in 2018, the experts were all warning there was going to be a housing crash by the end of the year—there wasn’t!

And I could go on and on.

This just proves the point that buying a house should never be based on what some expert thinks is going to happen in the housing market. The decision to buy a house should be made solely on the basis of your personal needs, circumstances, and ability to buy a home whenever the time is right for you.

However, if you need a few guidelines to help you decide whether to buy a house this year or wait, here are a few factors to consider.

Should I Be Buying This Year or Waiting—Six Factors to Consider First

If you are trying to decide when would be the best time to buy a house, sometimes asking yourself a few questions will help the decision-making process along.

1. Do I Have Enough for the Down Payment?

The more you put down on your new home, the better off you will be in the long run. Ideally, you should put down at least 20% of the cost of the home. This will keep you from having to pay private mortgage insurance (PMI). So, the more money you put down, the better interest rate you will receive, which will save you loads of money over the life of the loan.

2. How Much of a Mortgage Payment Can I Afford?

Yes, this is an obvious question, but more often than not, people get excited about buying a home and once that happens they find it hard to wait, so all restraint goes out the door. Therefore, make sure you review your budget before you do anything else. This will tell you exactly what you can afford to pay each month.

3. What Are My Credit Scores?

Lenders rely on many factors to determine whether they will approve your mortgage application; however, your credit score will determine whether they give you a loan or not. Then, of course, the better your credit score, the better interest rate you will get.

4. How Much Money Do I Have in My Emergency Fund?

If you don’t have any money in your emergency fund, it’s probably not a good idea to buy a home until you have enough money to cover unexpected repairs, replacements, job losses, and potential medical emergencies, etc.

5. Is My Financial Future Secure?

You can never truly predict how secure your financial future will be, but you can ask yourself how likely is it that you will remain consistently employed in your chosen field? And if you were to be laid off, how quickly would you be able to find another comparable job?

6. How Long Do I Anticipate Staying in One Place?

If your current lifestyle is one that allows you to live in one place for a long period of time, then you should be OK to buy a house. However, if your job or family situation is one that could change at any moment or changes frequently, then buying a house might have to wait.

Should I Buy a House in 2019?

As we mentioned above, don’t base your decision about whether to buy a home this year on what some “expert” is predicting the housing market will do. It’s always best to base your decision on facts.

Here are some historical trends and key market indicators that will help you make an educated decision about whether or not to buy a home in 2019.

➣ Study the Lakeland, FL Area Housing Market

There are several trends and Lakeland, FL market indicators that will help you determine when it’s the best time to buy. Those factors are—the current home inventory levels, the home pricing history of the area, number of days homes are on the market (DOM), market seasonality, and the current interest rates. Not the speculation of what the interest rates might do, but the current interest rates when you are ready to buy.

Let’s look at these factors in a little more detail.

- Current Home Inventory Levels

Supply and demand always dictate the price of just about anything. The same goes for the housing market. When there are more homes than buyers, the housing prices drop. When there are more buyers than homes, the housing prices increase. That’s just the way it is. So check the current home inventory level in your area and look at how it has been trending. And if you don’t want to pay more for a home, now might be the best time to buy.

- Home Pricing History for the Area

Home prices have been steadily rising across the country for the last few years and it appears this trend will continue through 2019 and maybe even through 2020. Your best bet is to take some time now to narrow down a location and a neighborhood, get your financial house in order, then talk with your real estate agent about your options. He/she will then find some homes to look at that meet your specific criteria. The longer you wait, the more likely it is you will have to pay more for those same homes later. Some areas are rising faster than others. And according to Realtor.com® Lakeland, FL could have the hottest market in the U.S. during 2019. So the sooner you buy a home the better.

- Number of Days on the Market (DOM)

The average number of days a home stays on the market has been continually dropping since 2010, which isn’t surprising since that’s when the infamous housing bubble occurred. Additionally, the number of days a home stays on the market is expected to continue dropping in 2019.

What does this mean for you?

Well, it means you need to act quickly if you are thinking about buying a home and just do it. It also means you need to be diligent about getting all your ducks in a row and act fast because the longer you wait, the more you will end up paying for any given home in a hot market.

- Market Seasonality

The housing market fluctuates depending on what time of year it is. So if you are planning on buying a home in the spring or summer, this is the time when inventory increases and days on the market decreases. So you don’t have the luxury of waiting when you find a house you really want to buy, because if you don’t act fast, someone else will!

- Current Interest Rates

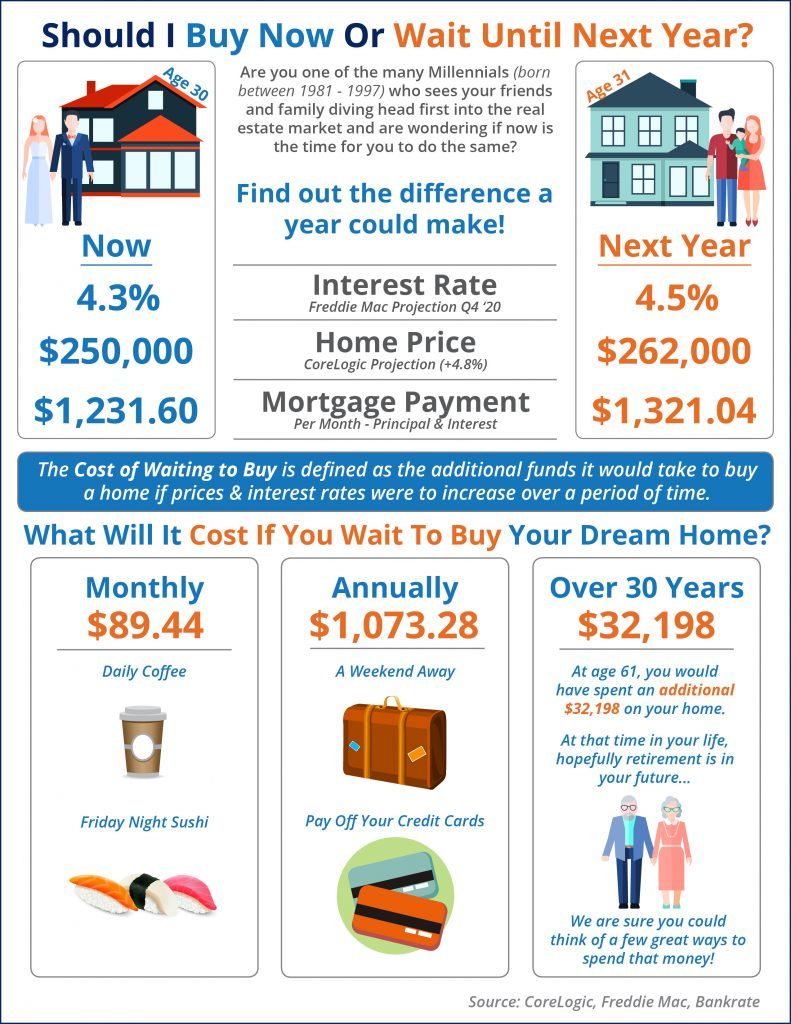

Current interest rates are a major factor for people who are deciding on when they should buy a house. And while the Federal Reserve hasn’t raised the rates at all this year, they did go up several times last year and could go up again at any time. Therefore, if you are serious about buying a home, do it now before the Fed decides to raise the rates again. If you wait, and the Fed raises the interest rates again, the same house will cost you much more money over the life of the loan even if the price of that home stays the same.

- Mortgage Delinquency Rates

The housing market is currently healthy, which makes it a good time to buy. Furthermore, mortgage lenders are significantly influenced by their view of how much risk they will incur. Therefore, the risk is lower when the current borrower delinquency rates are less—like they are now. And since lenders anticipate a lower delinquency rate in the near future, they are more likely to approve loans and offer better rates. This goes back to the economy and consumer confidence, which all contribute to a more favorable economic outlook.

The Pros and Cons of Buying This Year Versus Waiting

The best way to make a decision about anything is to do your research, then weigh all the pros and cons until you come to a decision. Here are some pros and cons of buying a house in 2019. You can use these pros and cons along with the other information in this article to make an educated decision about what’s best for you and your family.

Pros:

- Owning a home will build home equity. You can look at home equity like a savings account versus throwing your money away on rent. Therefore, the sooner you buy a house, the sooner you will start building equity.

- Buying a home now will cost you less than if you were to wait and the Fed starts raising the interest rates again.

- The current economy is strong helping to ensure job security and wage growth rates. If the economy tanks, fewer people will be buying homes. This is because most people fear layoffs and lower wages when the economy takes a turn for the worst.

- Renting, in most cases, will cost more than buying and you will be paying for something you don’t own, which means you don’t have any return on your investment. Therefore, the longer you rent, the more money you are throwing away.

- The Lakeland housing market is hot; therefore, any home you buy is likely to increase in value.

- Buying a house will provide you with additional tax deductions. And the sooner you buy a house, the sooner you will save money on your taxes.

- Buying a house with a fixed mortgage rate ensures you won’t have to budget for any more rent increases because your mortgage payment stays the same. Therefore, buying a house sooner rather than later will keep you from having to pay yet another rent increase and still have nothing to show for it.

Cons:

- Houses currently cost more than they did a year ago. However, if you wait, they could cost you even more.

- There’s a possibility the interest rates could be lowered; therefore, buying now would cost you more than if you waited. However, with the economy as strong as it is, it’s more likely the interest rates will be raised—not lowered. But you never know.

- Waiting will give you more time to build up a larger down payment, which, in turn, will lower your loan’s interest rate.

Sooo…should you buy a home this year or wait?

Why You Should Probably Buy Now Versus Waiting

Now is the time to buy, and here’s why…

Right now, the economy is doing great and wages are rising. And when people don’t have to worry about their jobs and are making more money, they are more inclined to buy a home, or a better home, and can afford to do so. Not only that but, home prices are continuing to rise and there’s nothing that indicates that trend is going to change any time soon. Therefore, if you wait to buy a home, you will likely have to pay more for it.

So don’t wait!

The Bottom Line

There’s really no right or wrong answer when it comes to the best time to buy a home. What truly matters is when it’s the right time for you. Yes, there are times when it’s better to buy a home and times when it’s better to wait. However, the real estate landscape is continually changing. Therefore, if you don’t make a decision, you might just find yourself in a constant holding pattern. Sometimes you just have to make up your mind and just do it.

What’s Next?

If you have questions or would like more information about buying a home, please Contact Us today. The Lakeland Real Estate Group will treat you with all the care and respect you deserve while walking you through the entire home buying process from start to finish. We look forward to serving you!

Other Valuable Resources to Consider

Mortgage after Bankruptcy – Eric Jeanette

Pros and Cons of the VA Loans – Luke Skar

First Time Home Buyer Tips – Bill Gassett

Top Struggles Of The First Time Homebuyer – What To Do About Them – Geoff Southworth

Buyer’s Agents Do More Than Just Unlock Doors – Kevin Vitali

About the author: The above real estate article “Should I Buy A Home This Year or Wait?” was written by Petra Norris of Lakeland Real Estate Group, Inc. With over 20 years of combined experience of selling or buying, we would love to share our knowledge and expertise. Petra can be reached via email at petra@petranorris.com or by phone at 863-712-4207

We service the following Central Florida areas: Lakeland, Auburndale, Mulberry, Winter Haven, Bartow, Plant City, Seffner, Valrico, Polk City, Lake Alfred, Lake Wales, Haines City, and Davenport FL.

Lots of things to consider for those considering a home purchase. These are great tips.