With all the talk of FHA Loans lately, it is sometimes easy to forget that those looking to buy Lakeland real estate with 20 percent to put down on a home purchase can also choose to opt for a Conforming Lakeland Mortgage.

With all the talk of FHA Loans lately, it is sometimes easy to forget that those looking to buy Lakeland real estate with 20 percent to put down on a home purchase can also choose to opt for a Conforming Lakeland Mortgage.

Here are a few facts about conforming mortgages and their loan amount limits moving into 2010.

A conforming mortgage is defined as one that “conforms” to Fannie Mae or Freddie Mac’s mortgage requirements. Each year, the government establishes the maximum allowable loan amounts for conforming mortgages, based on “typical” housing costs across the US. Any loan that exceeds this base mortgage amount limit is considered a “jumbo” mortgage.

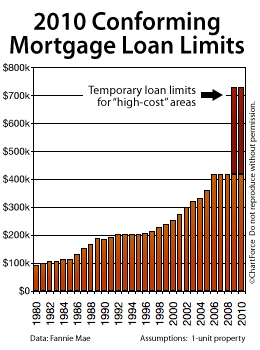

Just as US home prices increased from 1980 to 2006, so did conforming loan limits. However, as we’ve seen home prices decrease over the past few years, the conforming loan limit has ceased to climb and has instead held firm.

2010 Conforming Loan Limits Hold Firm for 5th Consecutive Year

Keeping in line with what seems to be financial tradition moving into 2o1o, the government set $417,000 as the nation’s 2010 single family home (including condos or other 1-unit dwellings) conforming mortgage loan limit.

The 2010 conforming loan limits, as released by the government, are:

- 1-unit properties : $417,000

- 2-unit properties : $533,850

- 3-unit properties : $645,300

- 4-unit properties : $801,950

However, it’s important to note that conforming loan limits don’t apply to all U.S. geographies equally. As a result of various economic stimuli since 2008, the government now considers certain regions around the country “high-cost” areas. In these areas, conforming loan limits can range to $729,750.

Lakeland falls within the $417, 000 single unit loan limit – with high cost areas relegated to Broward, Collier, Maimi-Dade, Manatee, Monroe, Palm Beach, and Sarasota counties.

The complete list is published on the Fannie Mae website.