Lakeland Florida Short Sale and Foreclosure Market Report – September 2010

For the month of September, the Lakeland real estate market of short sales and bank-owned (REO) properties market share increased to 67% from the previous month. There were a total of 130 distressed homes sold, compared to 108 in August and 99 distressed Lakeland homes sold the year prior, according to Mid-Florida Regional MLS.

Currently there are a total of 1867 Lakeland FL homes for sale and 491 homes under contract (10/26/2010). By calculating total inventory, homes that are under contract which are included in my inventory share because these properties have not closed in which a buyer could walk away at any given time.

Bank owned properties – Inventory share is 14,21%

Short sale properties – Inventory share is 28.03%

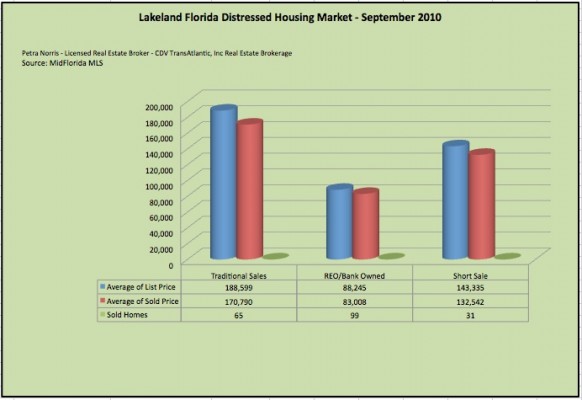

The Graph below compares sold homes in all categories – Traditional Sales (None Distressed), Lakeland Foreclosures (REO) and Lakeland Short Sales.

Average days to Closing for bank-owned properties are 106 days

Average days to Closing for other distressed properties are 250 days.

31 Lakeland FL Short Sale properties sold – average sold price $132,542 – median sold price $116,000

99 Lakeland FL Foreclosures (REO) sold – average sold price $83,008 – median sold price $55,000.

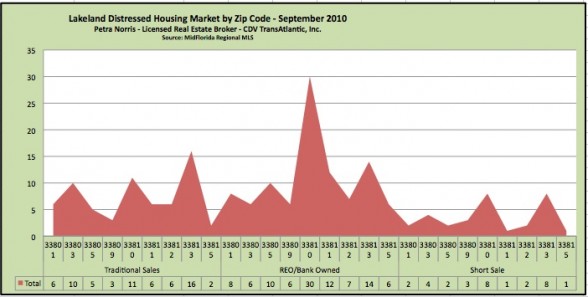

The graph below will give you a clear understanding where in Lakeland FL have the most foreclosures.

Looking for a great deal on Lakeland Short Sales and Lakeland foreclosures, feel free to contact me at petra@petranorris.com or click the search button below.

Copyright © 2010 By Petra Norris *Lakeland Florida Short Sale and Foreclosure Market Report – September 2010*

i just wanna thank you for sharing your this info on your blog