Lakeland mortgage borrowers will soon see a new version of the Good Faith Estimate required as part of every mortgage loan application beginning January 1, 2010.

Expanded from the usual 1 page to a total of 3 pages, this updated Good Faith Estimate should be simpler for Lakeland home buyers and those looking to refinance Lakeland homes to understand than the former version.

The new Good Faith Estimate provides “plain-English” explanations of each feee, charge, and interest payment involved in a purchase or refinance. It also includes a section called “The Shopping Cart,” which allows mortgage loan applicants to compare what they’d see from various mortgage lenders.

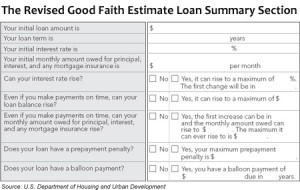

Despite moving up from 1 to 3 pages, the new Good Faith Estimate is actually more concise. Using a series of “Yes/No” check boxes on Page 1, mortgage lenders make very clear the following aspects of your Lakeland mortgage loan:

- The interest rate on the mortgage

- Whether the interest rate can change over time

- Whether the loan carries a prepayment penalty

- The length of the rate lock

This is a nice change, as at present – this information is spread across 3 separate forms.

Furthermore, the new Good Faith Estimate will make it much easier for Lakeland mortgage borrowers to compare rates and fees, showing applicants how a lower rate can be available for a higher set of fees, and vice-versa.

For all of its clarity, though, the new Good Faith Estimate still fails to address the issue of “suitability.” As in, is this the right loan for the right borrower? That’s something only a mortgage professional can do, and remains one of the key reasons to seek out a qualified local Lakeland mortgage professional.

As such, you need to be sure to select and talk with a mortgage broker who both listens to your needs and helps you plan for them. If you opt for the wrong terms on your Lakeland mortgage loan, you may be sorry in the long run. After all, great terms on an unsuitable loan are often worse than “good” terms on the right one.