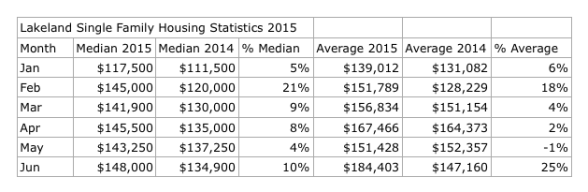

For the first half of 2015 the data gathered here is for you in order to provide you with a report on the median and average price for single family homes and villas sold in Lakeland.

Take a look at this chart so far for this year. We see that the median and the average home price is rising, similar to what we saw during the housing bubble:

If you are thinking about selling your Lakeland home, don’t over estimate the rapid rise in the median and average price as an indication of rising home values. We have to do a true comparison of your home to similar homes in your neighborhood before we can truly measure your home to see if the home has increased in value.

To find out the true value of your home, we offer a home valuation report free of charge, which will give you a very good indicator of your home’s value today. This report is a critical component by which you may base your decision on to sell your home. We can also arrange to do a report at a time convenient for you.

It is our recommendation to always find out the value of your home before deciding to put the property on the market as this will give you the best understanding and expectation as you prepare to sell and move.

What’s selling in Lakeland?

Statistics

For the first half of 2015, the homes that selling the most are in the price range from $140,000-$159,999, followed by $120,000-$139,999. Rounding out are homes sold in the price range of $100,000-$119,999.

The average days a Lakeland home is on the market for the first half was less than 90 days. While we experience currently a lower inventory with only about 3 months housing supply, the trend has shifted from a balanced market to a seller’s market. For more information about each of Lakeland’s zip code please click here

What can you expect for the remainder of 2015?

Lakeland housing market appears to be continuing strong for the remainder of the year due to supply and demand. If history is an indicator we can expect these numbers gradually improve from one year to the next until we finally hit another housing collapse. However, we don’t appear to be anywhere near given that current median home prices have not reached 2006/2007 median price levels.