The foreclosure and short sale market has affected all of us here in Lakeland, Florida with the ever decreasing home values in most neighborhoods if not all neighborhoods in our city. High unemployment rates, influx in foreclosed properties for the foreseeable future and shadow inventory that has yet to hit the real estate market. Therefore highlighting the Lakeland foreclosures and short sale market for sellers, home buyers and investors is very important in determining their options whether buying or selling.

Starting with this month Lakeland Florida Short Sale and Foreclosure market report, the distressed market report will have its own report.

For the month of January, Lakeland’s real estate market of short sales and bank-owned (REO) properties had a market share of 60%. There were a total of 88 properties sold in January compared to 60 distressed Lakeland homes sold the year prior, according to Mid-Florida Regional MLS.

Currently there are a total of 1,910 Lakeland homes for sale and 498 Lakeland homes under contract (02/18/2010). By calculating total inventory, homes that are under contract because these properties have not closed is included in my inventory share.

- Bank owned properties – Inventory share is 12.17%

- Short sale properties – Inventory share is 25.42%

The Graph below compares sold homes in all categories – Traditional Sales (None Distressed), Bank Owned Properties (REO) and Lakeland Short Sales

- Average days on market (DOM) for bank-owned properties are 45 days

- Average days to contract for other distressed properties are 136 days.

25 Distressed Homes Sold – average sold price $146,724 – median sold price $139,900

63 Bank-owned (REO) sold – average sold price $88,319 – median sold price $81,000

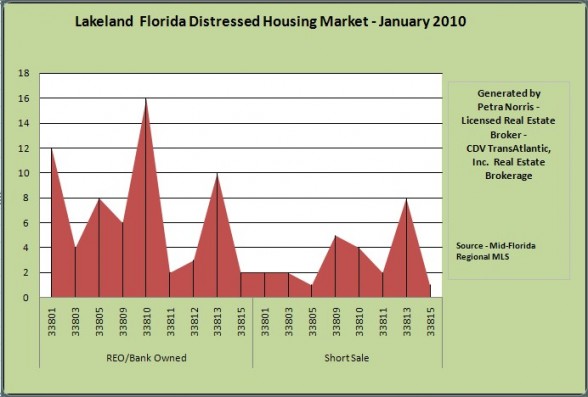

Distressed sales are scattered in all parts of Lakeland Florida as you can see from this graph below.

If you are interested in Lakeland Foreclosures and Short Sales, feel free to contact me at petra@petranorris.com or click the search button below.